Goods and Service Tax (GST) has been said to be the biggest tax reform in the tax structure of India. Unlike erstwhile excise duty which was an Origination based tax, GST is a destination based tax and levied at a single point at the time of consumption of goods or services by the ultimate consumer. In destination-based taxation, exports are allowed with zero taxes whereas imports are taxed on par with the domestic production.

Goods and Service Tax (GST) is an indirect tax levied on the supply of goods and services. This law has replaced many indirect tax laws that previously existed in India. Under the GST regime, the tax is levied at every point of sale. In the case of intra-state sales, Central GST and State GST are charged. Inter-state sales are chargeable to Integrated GST.

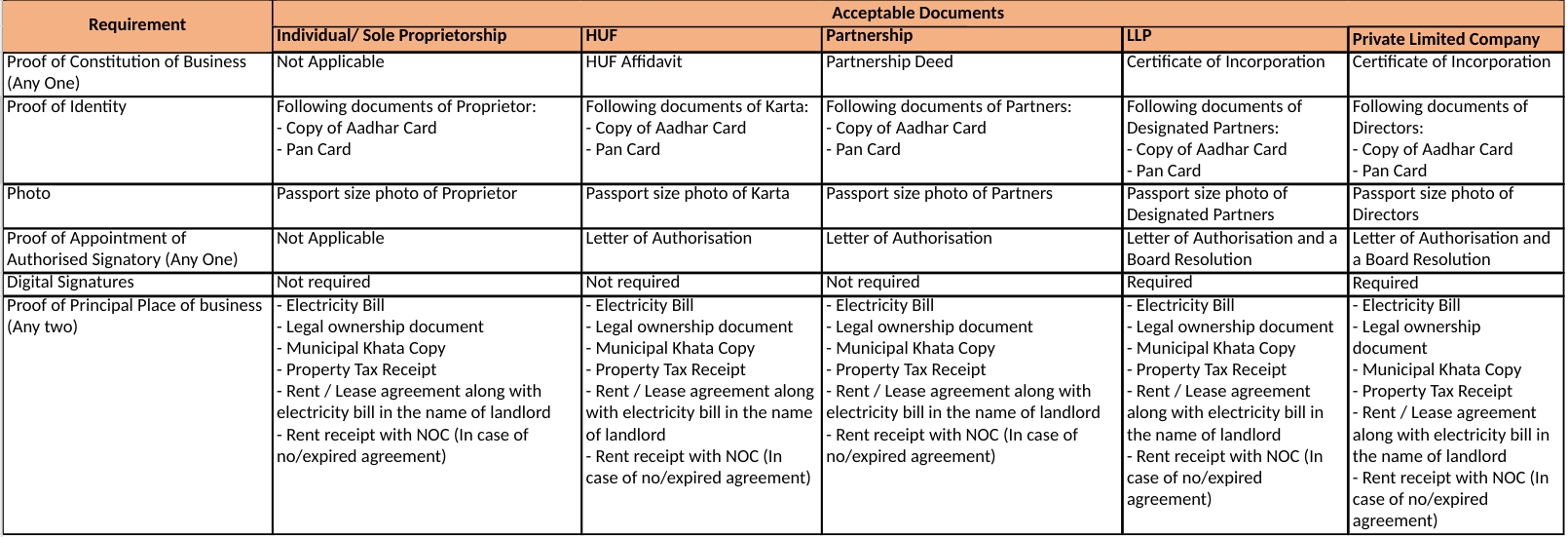

Every assessee with a business turnover of more than INR 40 lacs and professional turnover of more than INR 20 lacs is required to have a GST registraiton. Following documents are required for the GST registration: